In the United States, not only is it important to consider how to increase one’s income, but it is equally crucial to think about how to protect and save taxes on hard-earned income from employment and assets like real estate and stocks. We use our income from employment for various living expenses, and the remaining funds are saved and grown as assets. These living expenses include fixed costs such as utilities, rent/mortgage, shopping, food/clothing, and also taxes. To effectively grow our assets, it’s not just about living frugally to reduce unnecessary expenses; it’s also about utilizing various tax-saving strategies to minimize taxes as much as possible. This requires professional tax planning (Tax Planning) and its implementation, which is vital. In the U.S., where taxes are a significant portion of expenses, Tax Planning is an essential element of retirement planning. Key aspects of Tax Planning involve using the IRS tax code for legal tax minimization (Tax Avoidance) and avoiding illegal practices such as underreporting income or overstating expenses to reduce tax liability (Tax Evasion).

1. Maximizing Tax Deductions and Credits

A cornerstone of effective tax planning involves maximizing tax deductions and credits. Deductions lower your taxable income, thereby reducing your overall tax liability. This can include deductions for mortgage interest, state and local taxes, and charitable donations. Tax credits, on the other hand, are even more valuable as they directly reduce the amount of tax you owe, dollar for dollar. Examples include credits for education expenses, energy-efficient home improvements, and child care. Understanding and leveraging these tax benefits can significantly lower your tax bill, especially in high-income years.

2. Understanding the Three Major Types of Taxable Income

| Taxable Income | Kind of Income | Paid Taxes |

| 1. Active Income | Earned Income, Qualified Business Income | Ordinary Income Tax + Payroll Tax. Higher Tax Rate |

| 2. Portfolio Income | Long Term Capital Gain, Interest, Dividend, Royalty | Ordinary Income Tax/LT Capital Gain Tax. Lower Tax Rate |

| 3. Passive Income | Passive Business Income (Rental Income) | Ordinary Income Tax. There are many tax deduction items. |

In the realm of taxation, income is not just a simple number on your paycheck. It’s categorized into three major types, each with its unique tax implications. First, there’s Active Income, which comes from your job or business. It’s the most common type and is taxed at your regular income tax rate. Then there’s Portfolio Income, derived from investments like stocks and bonds. It’s subject to capital gains taxes, which can be lower than regular income taxes. Lastly, there’s Passive Income, which comes from rental properties or businesses where you’re not actively involved. This type of income has its own set of tax rules and advantages.

To minimize tax liability, consider adjusting the composition of your income sources. Reducing Active Income, which is typically taxed at the highest rate, and increasing your Portfolio Income or Passive Income can be beneficial.

Investors with assets in businesses or real estate often have access to more tax-saving strategies than those solely earning a salary, active income. This is because they contribute significantly to the U.S. economy through avenues like job creation. Recognizing this, the federal government provides various tax benefits to these investors. It’s essential for them to study and plan long-term to effectively leverage these advantages.

3. Balancing Savings with Tax Implications

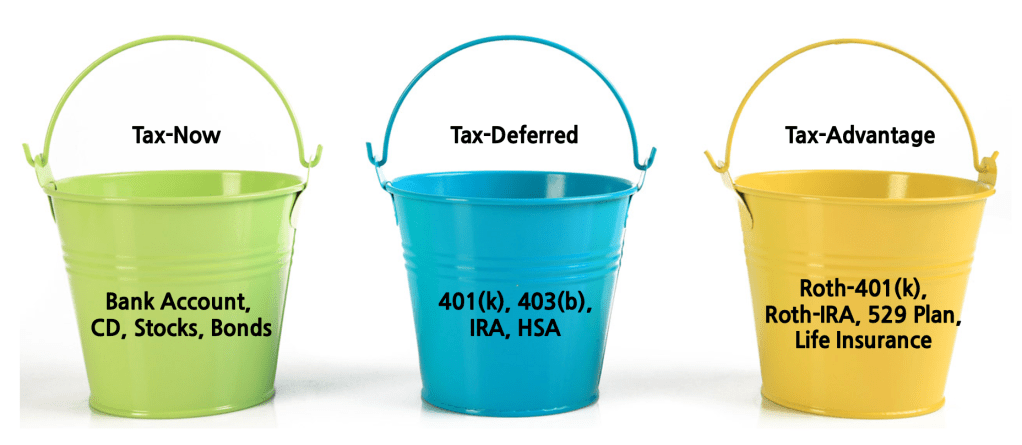

The Three Tax Buckets

Saving money isn’t just about putting it in a bank. It’s about strategically placing your savings in financial instruments that align with your tax goals. The US has three main ‘tax buckets’ for savings: Tax Now, Tax-Deferred, and Tax-Free. Each bucket has pros and cons, depending on your current income, expected retirement income, and other factors.

For instance, Tax Now accounts, like regular checking and savings accounts, tax you on the interest earned annually. Tax-Deferred accounts, like traditional IRAs and 401(k)s, allow your investments to grow tax-free until you withdraw them in retirement. Tax-Free accounts, like Roth IRAs, involve paying taxes upfront but offer tax-free growth and withdrawals.

Navigating the Three Tax Buckets for Optimal Asset Location: Choosing the right ‘tax bucket’ for your assets can significantly impact your financial well-being. Consider these guidelines:

– Tax Now Bucket: Ideal for funds you need readily accessible, like emergency funds and daily living expenses. Money saved here is taxed annually, but it’s always within reach for immediate needs.

– Tax-Deferred Bucket: Perfect if your goal is to lower your current income tax rate. This bucket allows your investments to grow tax-deferred, meaning you’ll pay taxes only upon withdrawal, potentially at a lower rate in retirement.

– Tax-Free Bucket: Best for those focusing on future asset growth, especially younger individuals. Here, you pay taxes upfront but enjoy tax-free growth and withdrawals. It’s a forward-thinking approach to financial planning, maximizing the benefits of long-term asset growth.

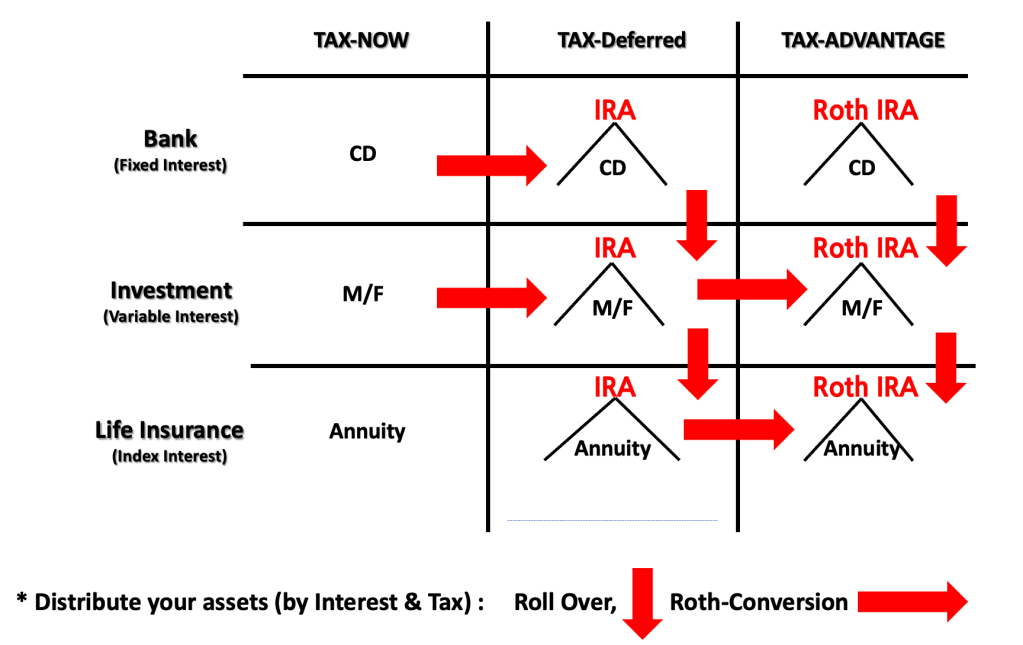

4. The Role of Rollovers and Roth Conversions in Retirement Planning

An important aspect of retirement planning in the U.S. involves understanding the concepts of Rollovers and Roth Conversions. A Rollover is when you transfer funds from one retirement account to another without incurring tax penalties, often done when changing employers. This allows for the continued tax-advantaged growth of your retirement savings. On the other hand, a Roth Conversion involves transferring funds from a Traditional IRA or 401(k) to a Roth IRA. This conversion requires paying taxes on the transferred amount in the year of the conversion, but it offers the advantage of tax-free withdrawals in retirement. Both strategies require careful consideration of your current tax bracket, expected future income, and retirement goals.

5. The Benefits of Early Tax Planning and Asset Diversification for Retirement

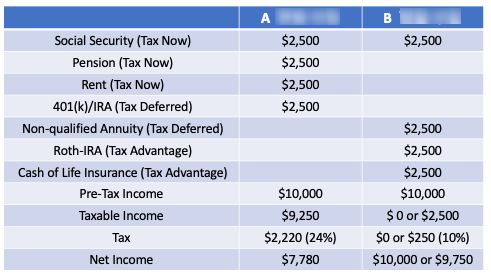

Comparison of taxable income between A and B

Imagine two grandfathers, A and B, as depicted in our example. Both have the same pre-tax income ($10,000), but their financial strategies lead to very different post-tax incomes in retirement. Grandfather A didn’t diversify his financial assets, resulting in a higher tax burden. Conversely, Grandfather B wisely diversified his income sources into non-taxable streams early on. As a result, even though his before-tax income matches Grandfather A, his after-tax income ($9,250) is significantly higher than Grandfather B ($0 or $2500). This scenario highlights the importance of early tax planning and diversification of financial assets. By doing so, retirees can enjoy a more substantial income post-retirement, with less of it eaten away by taxes.

Leave a comment